42+ paying off mortgage with ira after 59 1/2

Web Web If you pulled money out of your retirement accounts to pay off the 500000 by the time you paid off both the mortgage and the income taxes it could cost you about. While youre over 59½ years of age you still have to pay income.

Payoff Mortgage Early Or Ramp Up Retirement Abg

He also pointed out that if youre paying say 25 on your mortgage and you pay it off you essentially just earned that.

. Reach age 59 12. Web An even worse idea is withdrawing money from your IRA to pay off the mortgage. Youll pay 123609 in interest.

The 10 percent early distribution only applies to IRA distributions taken before reaching age 59 12. Ad Understand Your Options - See When And How To Rollover Your 401k. Web Standard 403 b withdrawal.

Web Thanks to the wonders of the standard deduction youre not deducting interest and that 3 mortgage is costing you the same 3 after taxes. Web Extra Mortgage Payments vs. Web Also the money you receive out of your IRA will be after-tax.

Web If you withdraw money from an IRA after age 59 12 you dont face an early withdrawal penalty but you do typically owe income tax on withdrawals unless you. So if you need 50000 in handyou will have to take out a larger total withdrawal from your IRA to. Schwab Has 247 Professional Guidance.

Web If you pulled money out of your retirement accounts to pay off the 500000 by the time you paid off both the mortgage and the income taxes it could cost you. Web Since you took the withdrawal before you reached age 59 12 unless you met one of the exceptions you will need to pay an additional 10 tax on early distributions on your. Web Heres a look at more retirement news.

Ill assume you are under age 59 12 since you are asking. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. With a traditional IRA youll owe tax on the distribution plus a 10 penalty if.

To access funds in your retirement account youll need to qualify through one of the following measures. Web Although it may seem like a good idea to pay off your mortgage the tax cost of making the lump-sum payment is prohibitive. So getting rid of a.

Withdrawals of earnings are penalty-free after age 59 12 and a 5-year holding period. Assume you have a 30-year mortgage of 150000 with a fixed 45 interest rate. It Is Easy To Get Started.

How Much Interest Can You Save By Increasing Your Mortgage Payment. Web Roth IRA withdrawal rules allow withdrawals of contributions any time.

The Weekly Post 1 29 15 By The Weekly Post Issuu

Bulletin Daily Paper 10 13 12 By Western Communications Inc Issuu

Should I Pay Off My Mortgage With Money From My 401 K The Washington Post

How To Withdraw From Your 401k Or Ira For The Down Payment On A House

How To Pay Off Your Mortgage Using Your Ira

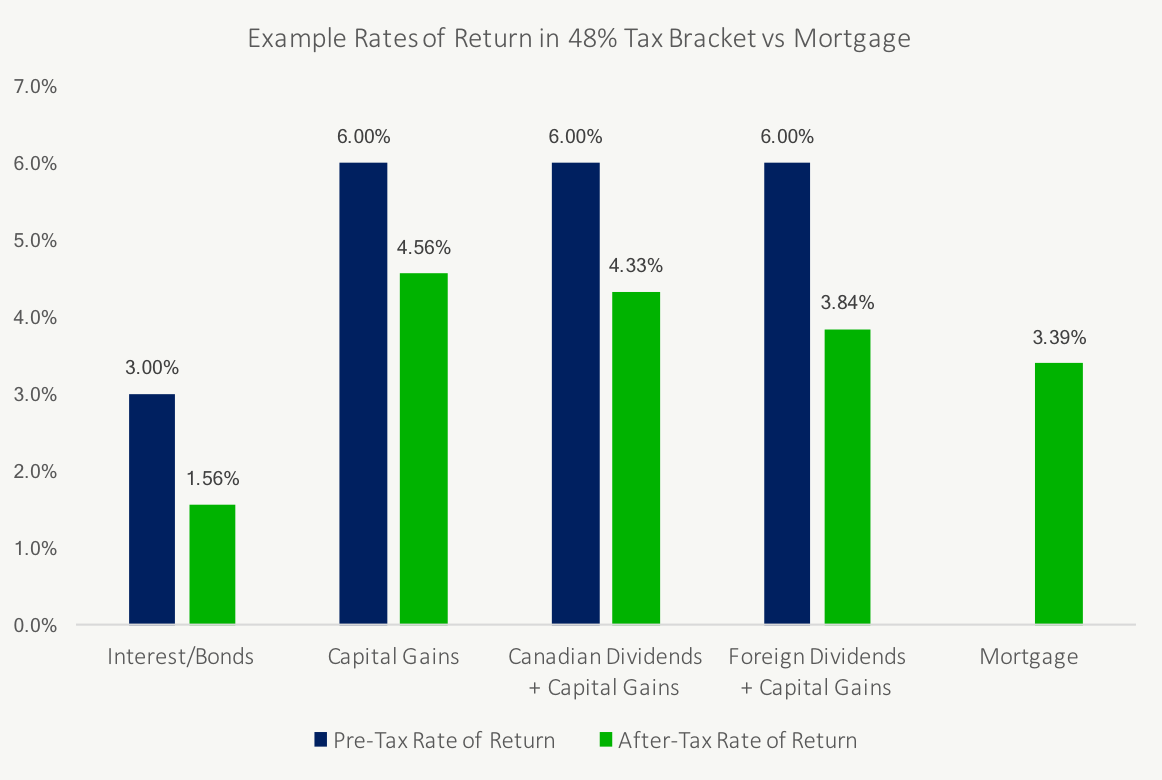

Should You Consider Paying Off The Mortgage Early Or Investing Instead Planeasy

Implications Of Using An Ira To Pay Down A Home Mortgage Budgeting Money The Nest

Implications Of Using An Ira To Pay Down A Home Mortgage Budgeting Money The Nest

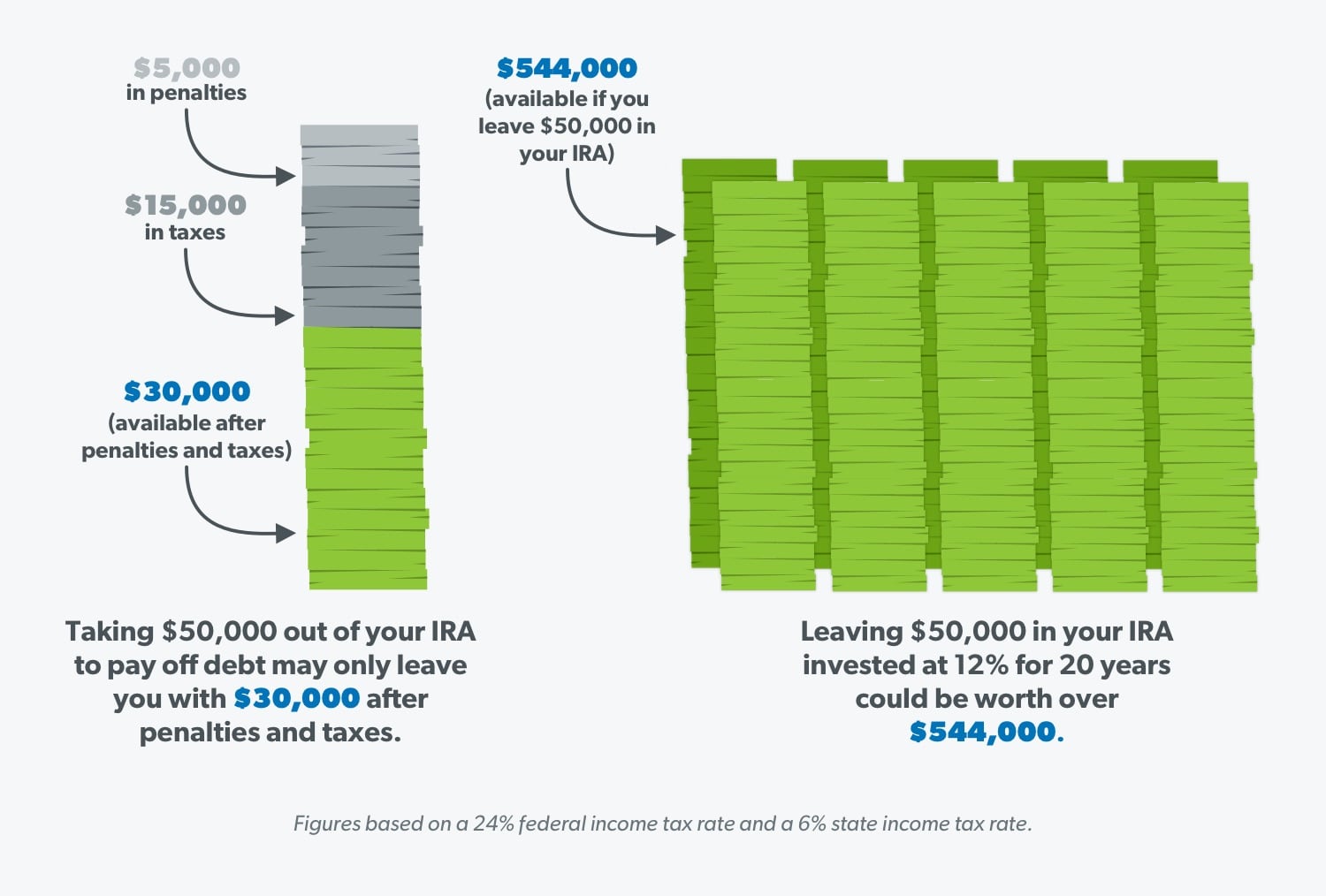

6 Good Reasons Why You Should Not Raid Retirement Accounts To Pay Off Debt And One Bad One From Dave Ramsey White Coat Investor

The Best Way To Pay Off A Mortgage In Retirement Carmichael Hill

Should I Take Money Out Of My Ira To Pay Off Debt Ramsey

The Best Way To Pay Off A Mortgage In Retirement Carmichael Hill

The Best Way To Pay Off A Mortgage In Retirement Carmichael Hill

Les 10 8 2015 By Shaw Media Issuu

Merrion V Jicarillo Pdf Tribal Sovereignty In The United States Government

Does Taking Money Out Of Your Ira To Pay Off Your Home Incur A Tax Penalty

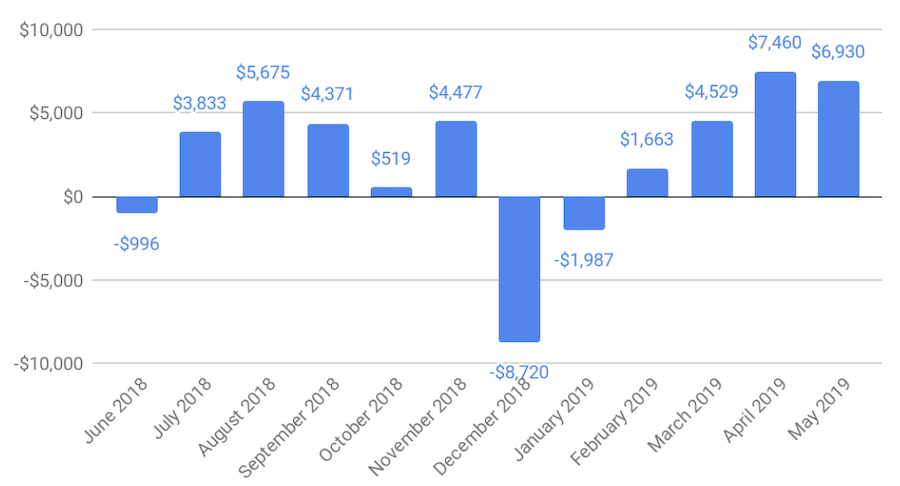

Mortgage Payoff Experiment